Child support in New Mexico

Child support ensures both parents financially support their children.

Although the court does not interfere in how you can spend child support, support is meant to cover the basics like food and shelter, plus additional expenses like childcare and health insurance.

The parent who spends less time with the child pays child support. If parents spend equal time with the child, the parent who earns more money usually pays.

The parent who pays support is the payer, while the parent who receives support is the payee.

If you are unmarried, you must establish the child's paternity before you can get a support order.

Child support guidelines

New Mexico's child support guidelines lay out the rules for establishing support amounts.

The guidelines include a basic child support schedule. It determines parents' basic support obligation (how much the state presumes they should spend on their children) based on their combined monthly income and number of children.

The payer's share of the obligation is equal to their share of the combined monthly income. For example, if they make 50% of the combined income, they're responsible for half the basic obligation. They pay this to the other parent as child support.

If they have at least 35% of the timesharing schedule, they pay a reduced support amount. And if a child has extra costs, the payer may pay an increased amount.

Use the calculator above to get a quick estimate of how much support you'll pay or receive.

Support worksheets

A child support worksheet calculates your exact support amount, adding expenses like the child's health insurance premium to the basic support obligation.

Use Worksheet A if the payer has less than 35% of parenting timeshare. Use Worksheet B if they have 35% or more timeshare.

Low- and high-income cases

If the payer's individual income and number of children fall within the shaded area of the support schedule, support is based solely on their income.

If parents have a combined monthly income over $40,000, the court may determine support based on circumstances (e.g., the child's lifestyle preseparation) rather than the worksheet calculation.

Getting a support order

You can ask for support when you petition for custody or divorce. You'll need to fill out a support worksheet as well.

If you agree on the support amount, attach a support agreement — or a parenting plan if you also agree on custody — to your petition. If your support amount differs from the worksheet's, explain why and how it will meet your child's needs.

If you disagree, request mediation to pursue an agreement or a support hearing to let a judge or hearing officer decide support. In either case, bring financial records (e.g., pay stubs) and a complete child support worksheet with you.

Applying for child support services (CSS) is another way to get a support order. You might go this route if you expect to need other help, like support enforcement.

Paying and receiving child support

New Mexico has several methods of paying support (wage withholding, online payment, etc.) and methods of receiving support (direct deposit, check, etc.).

The payer cannot withhold support payments because the payee denies visitation. The payee cannot deny visitation because the payer misses support payments.

The support payee isn't required to report how they spend support funds.

Enforcing child support

The Child Support Enforcement Division handles support order enforcement.

If you're enrolled in CSS, contact your caseworker when the payer misses a payment.

If you're not enrolled, you can file a Motion to Modify or Enforce Child Support Order with the court. Another remedy is to request wage withholding to automatically deduct the support amount from the payer's income.

Neglecting support payments can result in penalties, such as seizure of income tax refunds, driver's license suspension and even jail time in severe cases.

If you're a payer who's having trouble paying support, contact your CSS caseworker or inquire with the court.

Modifying child support

To request a change to the child support amount, fill out a Motion to Modify or Enforce Child Support Order.

The court will only modify a support order that is at least one year old. You'll need to fill out a support worksheet to prove the new support amount would be at least 20% more or less than the current order.

Calculating your timeshare

To determine timeshare, New Mexico courts use the number of 24-hour days each parent has with the child in a year. Because counting manually is time consuming, they usually rely on estimates.

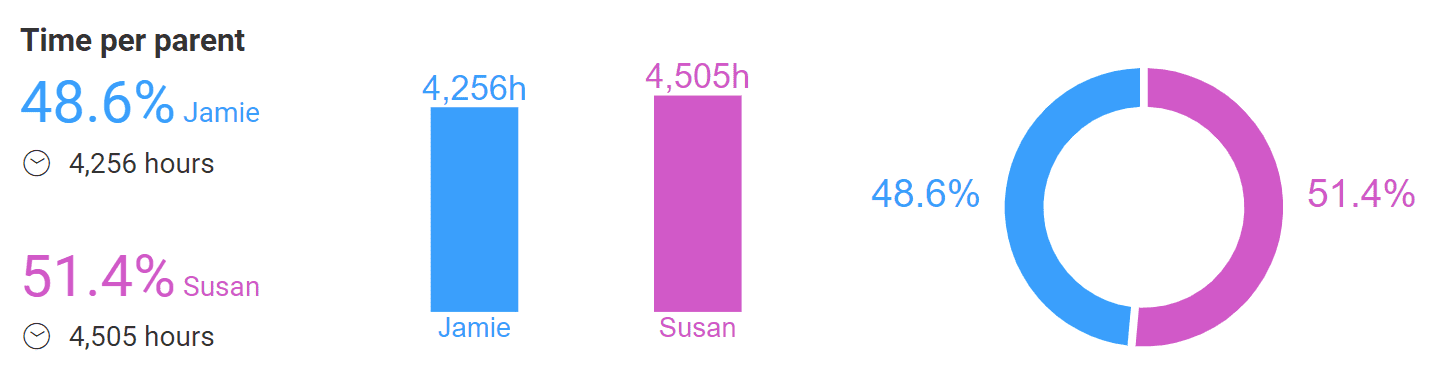

But estimating parenting time can impact your child support order by thousands of dollars a year. The Custody X Change app lets you quickly calculate your exact timeshare.

Our software will calculate hours for you. Simply divide your total hours by 24 to get the number of days. (Twenty-four hours of parenting time do not have to be consecutive to count as a day.)

You can customize this to fit your situation with Custody X Change.

Add 3rd party time to your schedule to exclude time the child spends at school, daycare, etc. from the timeshare calculation. This could convince the judge or hearing officer that the payer should (or should not) qualify for a shared parenting discount, which requires at least 35% of timeshare.

With Custody X Change, you can tweak your schedule to see how even little changes affect your timeshare. And you'll see how it changes each year due to holidays and other events.

You'll also avoid common math errors, such as counting holiday time as an addition to regular timeshare rather than a replacement.

Whether you are paying or receiving child support, make sure your timeshare calculation is exact. The number that will affect you, your child and the other parent for years to come.