Child support in Kansas

Even after they separate, parents must financially support their children.

Because the residential parent covers most of the child's daily expenses, the nonresidential parent pays monthly child support to even out the responsibility.

In a shared residential custody arrangement, where the child spends roughly equal time with each parent, the parent who does not pay the child's major expenses pays support (unless they earn much less than the other parent). If the parents share expenses, the higher-earning parent pays support.

The parent who pays support is the payor. The parent who receives support is the payee.

Kansas child support guidelines

Courts use the Child Support Guidelines to determine appropriate support amounts.

Within the guidelines are child support schedules (aka tables) listing basic support obligations based on the parents' combined monthly incomes, number of children and the children's' ages.

To decide your monthly payment amount, your judge will adjust the basic support obligation based on factors like:

- Child support paid for other children

- Cost of work-related child care

- The child's health and dental care premium

- The child's special needs (e.g., special education, cost of medical treatment)

- Parenting time

If parents' combined gross monthly income is $18,000 or more, the court could order an amount greater than the highest guideline amount if it's in the best interests of the child.

Adjustments for primary residential custody

If the payee has primary residential custody, the payor may pay a reduced support amount based on the payor's parenting time.

- 35 to 39% of parenting time: 10% adjustment

- 40 to 44%: 20% adjustment

- 45 to 49%: 30% adjustment

If the payor has a history of not exercising parenting time, the court may apply an upward adjustment.

Adjustments for shared residential custody

If the parents have shared residential custody, they use either the shared or direct expense adjustment (detailed in the Child Support Guidelines).

The shared expense formula is for parents who agree on how to split all direct expenses (i.e., expenses paid specifically for the child, like school and extracurricular costs). Child support is cut significantly as a result.

The direct expense formula is for parents who do not agree on how to share direct expenses. One parent pays all direct expenses (other than clothing, which both parents must buy), and the other pays the calculated child support amount, which will be higher than with the shared expense formula.

In either case, each parent covers their own indirect expenses (which aren't only caused by the child), like food, housing and utilities.

Estimating and calculating support

The calculator at the top of this page gives you a quick estimate excluding adjustments. Another support calculator commonly recommended by lawyers is eFamilyTools. It gives you an estimated support amount including adjustments.

Each parent must fill out a Child Support Worksheet to detail their financial situation and calculate a precise support amount. The worksheet amount is generally what your judge will order.

Parents may create a written agreement for child support. If it differs from the worksheet amount, they must explain to the court why the alternate amount is best for the child.

Applying for support

There are a few ways to start a child support case:

- Apply to Child Support Services (CSS)

- Apply for public assistance (e.g., Temporary Assistance for Needy Families)

- File for divorce or paternity establishment

With the first two options, the state starts the case for you. However, if you are still married to the other parent when you apply for public assistance, the state may or may not start a case.

Paying and receiving child support

The Kansas Payment Center processes most support payments. Support is typically paid by income withholding. This is when the payor's employer deducts the money from the payor's wages. Alternatively, the payor can pay support online.

By agreement, support payments can go directly from the payor to the payee if the court approves, though this is rare. The payor must give the court an annual record of payments, including copies of receipts, check numbers, etc.

The payee typically receives support through direct deposit.

If a child receives public assistance, the state keeps a portion of the support amount because the support is considered Title IV-D child support. Even after the child stops receiving benefits, the state will keep a portion of the support payments until fully reimbursed.

Modifying child support

If there's a significant change in circumstances, you can ask the court to change your support order. You'll need to fill out another Child Support Worksheet and pay a filing fee.

Reasons to modify support include:

- A child entering a higher age bracket (These are listed in the support schedules as 0–5 years, 6–11 years and 12–18 years.)

- Changes in either parent's income (but not the payee earning more)

- Changes in the cost of child care

- Changes in the child's health insurance costs

- Changes in parenting time

For the last four bullets, the court will only approve a modification if the new worksheet amount is 10% more or less than the current support award.

If you think support should change or stop because of parenting time, you'll need to change your parenting time order as well to formalize any schedule changes.

Enforcing child support

If you're enrolled with CSS, the Department of Children and Families (DCF) enforces your support order. Otherwise, your local court trustee's office does.

Each parent pays half of the enforcement fee, which is calculated into the monthly support amount. Fees vary by location.

Late payments are reported to credit bureaus. The court will generally give the payor a chance to make a payment arrangement. If the payor refuses, possible penalties include:

- After 30 days, liens are placed on any vehicle, boat or aircraft owned by the payor.

- After six months, the payor's driver's license is suspended (if they can pay support but choose not to).

- If nonpayment is a chronic issue, the payor may face jail time.

If you're struggling to pay support, contact DCF or the court trustee immediately to look into making a payment arrangement.

Parents should not withhold support or parenting time to get the other parent to follow a court order.

Ending child support

Child support ends once the child turns 18 and graduates high school. If the child is younger than 18 when they graduate, support continues until they turn 18. It can continue past 18 if parents agree.

You may need to file a Motion to Terminate Child Support if the order doesn't stop automatically.

If some children in the order are still eligible, support is reduced. For example, if you have four children and one is no longer eligible, support is reduced by one-fourth.

If there's any unpaid support (arrears), payments will continue until they're paid off. Some payors qualify to have arrears forgiven.

Getting an accurate child support order

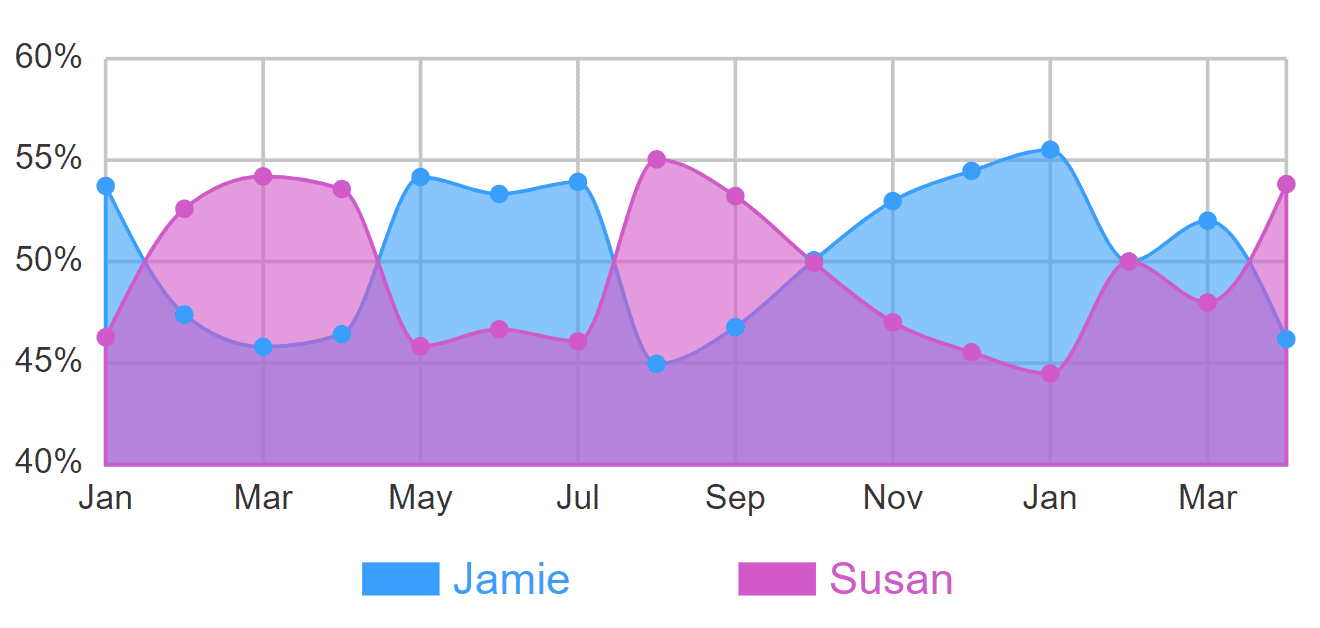

Estimating your parenting time can impact your child support order by thousands of dollars a year.

Still, attorneys and the court usually estimate because manually tallying parenting time is time-consuming.

The Custody X Change app lets you quickly calculate your time with your child.

You can customize this to fit your situation with Custody X Change.

With Custody X Change, you can tweak your parenting time schedule to see how even little changes affect your time with the child. Plus, you can see how the number changes each year due to holidays and other events.

Whether you're paying or receiving child support, make sure your calculation is exact. The number will affect you, your child and the other parent for years to come.