Qualified Domestic Relations Order (QDRO) In Divorce

When you split money and property in a divorce or legal separation, a state authority (usually a court) approves your settlement agreement or decides for you how you must divide your assets. You get an order to make it official. It's called a domestic relations order. However, it can't address certain kinds of retirement accounts.

If you're splitting a 401(k) or any retirement account covered by the Employee Retirement Income Security Act (ERISA), you need a qualified domestic relations order (QDRO). Typically, one spouse files the QDRO to seek the money in the other's retirement account.

If you're considering this option, it's a good idea to hire a lawyer who's experienced with taxes and investments.

Get to know QDRO: Meaning and law

A QDRO (commonly pronounced "quadro") determines who receives the money in a retirement plan. Withdrawals from a retirement plan are called distributions.

The order specifies what dollar amount or percentage of each distribution will be kept by the person who owns the account (the participant). It designates the rest of those payments for someone else (an alternate payee), who must be the participant's current or former spouse, child or other dependent.

The order specifies the total number of payments or a time period over which they should be made. The money can be paid out as a lump sum.

Consult your state law

Federal law only defines QDROs to be used for ERISA-covered plans, like 401(k)s.

Some states have laws defining QDROs for non-ERISA plans too, like IRAs or government or church retirement plans. For example, in Texas, a QDRO can affect the types of retirement plans that are common for workers in Texas state agencies or state universities.

Tax effects of a QDRO with a spouse

Many retirement plans, including 401(k)s, are tax-deferred, meaning the worker doesn't pay income tax when they invest but will owe the tax years later when that money is distributed to them.

A QDRO shifts some tax responsibility to the spouse.

Without a QDRO: The person whose account it is (the participant) owes income tax, as well as a 10-percent tax penalty if they take the distribution before they've reached retirement age. They might choose to give that money to their spouse, and their spouse wouldn't owe tax on it. However, since the distributions are voluntary, the spouse can't count on receiving any money at all.

With a QDRO: The participant's spouse is responsible for paying taxes on the part of the distribution they receive. As the QDRO helps guarantee they receive the money, the spouse may not mind this. The participant may also prefer this arrangement because they don't owe income taxes on the amount they're sending to their spouse, and they may also avoid the tax penalty.

If a spouse doesn't need to use this money yet, they may be able to invest it in their own retirement account, putting it permanently in their own name. That's called a rollover. By doing so, they'd avoid paying taxes until they needed to take a distribution. They could transfer money directly between financial institutions or send it to their bank account with the intent that they reinvest it promptly.

If the participant sends distributions to a child or dependent, with or without a QDRO, the participant owes the income tax.

QDRO process: What you need to do

Remember that if you're having trouble reaching agreement with your spouse, you can consider divorce mediation to help you negotiate and settle.

These are the basic steps of the process. If you have a lawyer, they'll handle this for you.

- The QDRO is drafted.

- The QDRO is sent to the retirement plan for pre-approval.

- Both spouses sign the pre-approved QDRO.

- The QDRO is sent to a judge for approval.

- The court-approved QDRO is sent to the retirement plan, which ideally approves it.

- The retirement plan makes distributions using the timeline the document specifies.

Once the money is paid out, it can be used to catch up with child support and alimony.

QDRO in divorce

It's often most convenient to handle the QDRO during a divorce case. That helps the retirement assets to be considered along with child support and alimony. Your local judge may want to consider the retirement assets, and state child support guidelines may require them to be factored in.

In a contested divorce, you'll have a discovery process to share your financial information.

Eventually, your whole divorce case, including the QDRO, ends up before a judge.

QDRO after divorce

The QDRO steps are essentially the same whether you do them as part of a divorce or legal separation or after that case is finalized. However, seeking a QDRO outside of a divorce is a separate legal effort, requiring more time and money. As you don't already have a case going before a judge, you'll need to submit the QDRO on its own to your local court.

How to create a QDRO without a lawyer

It's best to seek an experienced lawyer, especially if your financial situation is complex or the amount of money at stake in the retirement plan would be significant to you.

If you don't have a lawyer, see if the retirement plan provides their own QDRO form. The money is on their financial system and they'll have to make the transactions, so they have to understand the order. Likely, they already have a form they prefer.

As long as a document contains the required legal language, it can be a valid QDRO. You could include this language within a comprehensive financial agreement. However, when people submit a QDRO to a retirement plan, they usually use a separate document to avoid sharing unnecessary financial information with the investment company.

Consider the actual balance of the account. A QDRO can't order the retirement plan to pay money that isn't in the account nor to deliver benefits that aren't part of the plan.

How long it takes to receive funds from a QDRO

A judge might need a couple months or more to review and approve a QDRO. Once they do, the certified copy must be sent to the retirement plan so they can comply with it. The law allows them 18 months to approve or reject it.

Whether you can receive money immediately depends on the type of retirement plan:

- From a direct contribution plan like a 401(k) or 403(b), distributions can be made immediately.

- From a pension plan, both spouses must wait until the participant retires.

Consider this as part of the comprehensive financial planning you need to do as part of your divorce.

Who pays the QDRO fees

There's no standard fee, but expect to pay for your QDRO. Possible fees include:

- The retirement plan may charge an administrative fee to process it.

- The local court may charge to review and approve it.

- Some people hire a professional document preparer, like an accountant or actuary.

- Some people hire a lawyer.

Your lawyer may charge only several hundred dollars for what's usually a quick task during a divorce or legal separation.

If you're already divorced, consider that your spouse may not share your sense of urgency about the QDRO and may fight it. For the extra time your lawyer spends, they could charge several thousand dollars in legal fees.

Staying organized during your divorce

Dividing assets is an important part of a divorce, but there's more. If you're seeking child custody, you may need to create a parenting plan, propose a visitation schedule and beyond.

You may want to track your actual parenting time too. If you have your child more than you are scheduled, you can go to court to change your child support payments or to claim your child as a dependent.

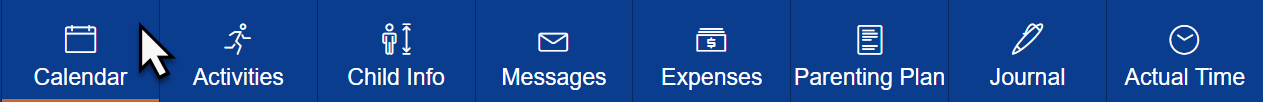

The Custody X Change app enables you to do all that in one place. As a bonus, if your lawyer uses Family Law Software for property division, they can import your Custody X Change data.

With a parenting plan template, custody calendars, an expense tracker and more, Custody X Change makes sure you're prepared for whatever issues may arise during your case.

You can customize this to fit your situation with Custody X Change.

Take advantage of our technology to stay on top of all the moving parts of your case.