Who Claims a Child on US Taxes With 50/50 Custody?

Having a child may entitle you to certain deductions and credits on your yearly tax return.

The Internal Revenue Service (IRS) typically allows the parent with whom the child lived most during the tax year to claim the child. But who gets to claim the kids if you have joint custody?

The answer lies in either your parenting time, your income or your agreement with the other parent.

Understanding whether you're eligible to claim your child could potentially save you from an audit.

Can I claim my child?

Tax law mentions custodial and noncustodial parents but does not mention joint physical custody or 50/50 custody.

Here's what it does say. You must meet the following qualifications to claim a child on taxes. (Certain credits and deductions may have slightly different rules.)

The child must have any of the following relationships to you:

- Child, stepchild, adopted child or foster child

- Brother, sister, half-brother, half-sister, stepsister or stepbrother

- Grandchild, niece or nephew

They must meet at least one of the following descriptions:

- Be under 19 at the end of the tax year and younger than you

- Be under 24 at the end of the tax year, younger than you and a full-time student for at least five months out of the year

- Be any age and totally and permanently disabled at any point during the year

And the following must both hold true for the child:

- Lived in the same home as you for at least half of the tax year

- Did not pay for more than half of their own living expenses during the year

Can both parents claim the child on taxes?

Only one person can claim your child on their yearly tax return.

If parents truly did spend an equal number of days with the kids — possible in a leap year or when the child spends time with a third party — the parent with the highest adjusted gross income (AGI) can claim the child.

If two parents claim the same child, the IRS could reject one or both tax returns. Parents will have the chance to make corrections, but if neither removes their claim to the child, the IRS will likely audit them both. Eventually, the IRS will determine which parent can claim the child.

If no parent claims the child despite qualifying to do so, a third party (e.g., a relative) can claim the child, so long as they have a higher AGI than either parent.

Can the noncustodial parent claim the child on taxes?

The noncustodial parent can claim the child on taxes if the custodial parent signs a Release of Claim to Exemption. The noncustodial parent would attach this to their tax return and submit it to the IRS. However, they would still be unable to file as head of a household based on that child or to claim the Earned Income Tax Credit or Child and Dependent Care Tax Credit (details below) based on that child.

Even if the noncustodial parent can't claim the child as a dependent, they may qualify for the Earned Income Tax Credit (more below) so long as they meet the income requirements for that tax year.

Can parents choose who claims the child on taxes?

Yes, as far as the IRS is concerned, parents can choose. Parents can agree on who gets to claim the child regardless of which custody arrangement they have. If only one parent qualifies for the tax year, they'd have to sign a Release of Claim to Exemption form for the other parent to submit with their tax return.

Typically, parents with joint custody take turns claiming a child based on even- and odd-numbered years.

When you have multiple children, you can divide them between you. If you have an odd number of kids, take turns who claims the greater number of children each year. For example, when parents have three children together, each parent can claim one child every year, then claim the third child in alternating years.

However, the court order in your divorce or custody case may say which of you gets the tax exemption. If it does, you can't choose otherwise. Follow your court order. The IRS may not enforce what your family court ordered, but the family court can enforce it.

What credits are available for parents to claim?

Head of Household (HOH) filing status

Filing as head of household means you'll have a lower tax rate and a higher standard deduction than if you were to file as single. To file as HOH, the IRS must consider you unmarried, meaning you meet the criteria below:

- You don't file a tax return with a spouse.

- You've paid more than half the cost of maintaining your home for the past year.

- You did not live with a current or former spouse for the last six months of the tax year.

- You provided the primary home for your child for at least six months of the tax year.

- You're able to claim the child as a dependent.

Child Tax Credit

You could get a child tax credit for each of your dependent children under 17. In addition to being a U.S. citizen, they must be your child, stepchild, adopted child, sibling or step-sibling (or a descendant of these people), or an eligible foster child.

Child and Dependent Care Tax Credit

This credit is for a parent who paid for someone to look after their child (under age 13) while the parent was working or looking for work. If you qualify, you'll receive a credit for a percentage of the expense, based on your adjusted gross income.

Earned Income Tax Credit (EITC)

The EITC is a tax break for low- to moderate-income families. To qualify, your income must not exceed the maximum adjusted gross income the IRS lists for the tax year. You may still qualify for this credit even if you can't claim your child.

Designating who can claim the child on taxes in your parenting plan

Designating who can claim the child on taxes in your parenting plan takes away any uncertainty. Parenting time and incomes can fluctuate, making it hard to guess which joint custodial parent will qualify each year; putting an agreement on paper saves you this confusion.

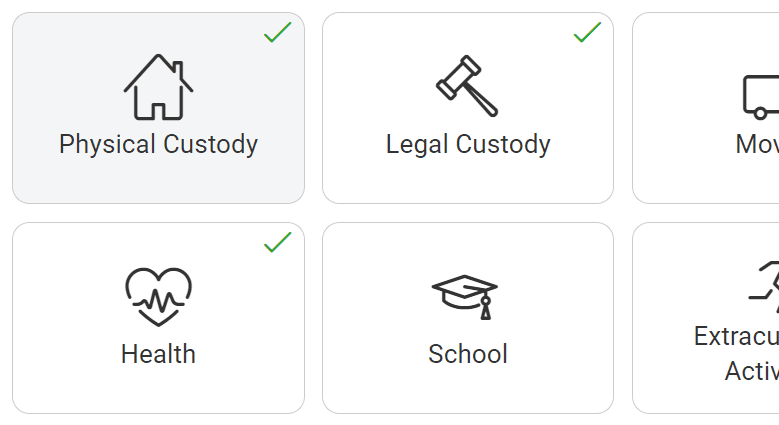

In the Custody X Change app, click the "parenting plan" tab. More than 25 categories of parenting provisions will appear.

You can customize this to fit your situation with Custody X Change.

Click the "taxes" category, then choose an option or write in your own.

You can customize this to fit your situation with Custody X Change.

Including a tax provision in your parenting plan will save you a lot of time and stress.