Pennsylvania uses a guideline child support formula to determine how much parents should contribute financially to their child's care. Judges can award a slightly different amount under certain circumstances, and parents can agree on a different amount with court approval.

Child support covers the child's basic necessities: food, clothing and shelter. Support payments continue until the child turns 18 and finishes high school.

Usually, the parent with less custody time pays support to the other parent. If parents spend equal time with the child, the one with the higher income pays.

Estimating your guideline child support obligation

Follow the steps below or use the child support calculator above or Pennsylvania's child support estimator to estimate your child support payment.

Step 1: Find each parent's monthly net income

Add up your monthly income from salaries, wages, bonuses, commissions and other sources, excluding Social Security and welfare. Subtract qualifying deductions, such as support for other children, mandatory union dues and what you pay in federal, state and local taxes.

Repeat the process for the other parent.

Example: Consider the hypothetical case of Keith and Audrey. Keith has primary physical custody of their children and a monthly income of $2,500 after deductions. Audrey has a monthly income of $3,500 after deductions.

Step 2: Calculate combined monthly parental income

Add each parent's total from Step 1 together to get combined monthly net income.

Example: Keith and Audrey add their monthly net incomes together to get $6,000.

Step 3: Determine each parent's percentage of the income

Divide the individual monthly income (from Step 1) of the parent with less parenting time by the combined monthly net income (from Step 2) to determine what percent they contribute.

Example: Audrey, the parent with partial physical custody, divides her monthly earnings of $3,500 by $6,000 to get 0.5833, meaning she earns 58.33 percent of the combined income.

Step 4: Find parents' shared basic support obligation

On the basic child support schedule, find your combined monthly income in the left column and the number of children addressed by this case in the top row. (If your combined income falls between two amounts shown, the court tends to round up.) The dollar amount where they intersect is the basic support obligation you share with the other parent.

Example: With a combined monthly parental income of $6,000 and three children, Audrey and Keith share a basic support obligation of $1,918.

Step 5: Find the individual basic support obligation

Multiply the shared basic support obligation by the income percentage of the parent with less custody time (from Step 3).

Example: Audrey multiplies $1,918 by 0.5833 for a guideline monthly payment of $1,118.77.

Step 6: Make adjustments for additional expenses

Finally, you need to adjust the individual basic support obligation to account for additional expenses like child care, health insurance premiums and private school tuition.

If parents have shared physical custody, they typically split these costs 50/50. In other physical custody arrangements, each parent pays an amount proportionate to their share of the income (from Step 3).

Determine how much the parent with less custody time should pay for additional expenses according to these guidelines. If they should pay more than they currently do, add the difference to their basic support obligation. If they should pay less than they currently do, subtract the difference from their basic support obligation.

Round the adjusted amount to the nearest whole dollar. This is how much the parent with less custody time owes monthly, per Pennsylvania guidelines.

Example: Keith and Audrey's only additional expense is health insurance for the children. It totals $400 a month, and Audrey currently covers $100. Since she has partial custody and makes 58.33 percent of the combined income, she should pay $233 for the insurance (.5833 X 400). In other words, she is paying $133 less than she should. This amount gets added to her basic support obligation (1,118.77) for a total of $1,251.77.

After rounding, Audrey owes Keith $1,252 a month in child support, according to the state guidelines.

Reasons to deviate from the guideline formula

Parenting time

The guideline formula presumes the parent paying support has between 30 and 40 percent of annual overnights in the custody schedule.

When the paying parent has the child for less than 30 percent of the nights in a year, the receiving parent can request extra child support.

When the paying parent has at least 50 percent of overnights, the court reduces their percentage of the combined monthly parental income by 20 percent. When they have at least 40 percent of overnights, the court reduces it by 10 percent.

Example: Audrey spends three overnights a week with the kids (roughly 43 percent), so she qualifies for a 10 percent reduction in her percentage of the combined income. She takes her percentage from Step 3 (58.33 percent) and decreases it by 10 percent to get 48.33 percent. She uses this as her income percentage in Steps 5 and 6.

Low income

The court may lower the paying parent's obligation if the guideline amount would leave them with less than $981 of monthly income.

It may also lower the obligation if the parent's individual monthly net income (from Step 1) and number of children intersect within the shading on the basic support schedule. The number they intersect on is your adjusted payment amount, as long as it's less than your guideline monthly payment from Step 5.

Example: Consider Paul, who has a monthly net income of $1,150 and two children in his current case. The support schedule shows his obligation is $79, due to his low-income status.

High income

When combined monthly parental income exceeds $30,000 after deductions, it's literally off the court's chart.

To determine the parents' basic support obligation, the court starts with the basic obligation for $30,000 (which varies by number of children in the case, as outlined below). Then it adds a portion of the income over $30,000 to the obligation.

- One child: $2,839 plus 8.6 percent of the combined monthly income over $30,000

- Two children: $3,902 plus 11.8 percent

- Three children: $4,365 plus 12.9 percent

- Four children: $4,824 plus 14.6 percent

- Five children: $5,306 plus 16.1 percent

- Six children: $5,768 plus 17.5 percent

Example: Fern and Roger have two children and a combined monthly income of $35,000. They find the highest support obligation on the schedule for their number of children is $3,902.

Next, they multiply $5,000 (the amount of their income over $30,000) by 11.8 to get $59,000. They divide that by 100 to determine they must add $590 to the amount from the schedule.

They add $590 to $3,902 to determine their adjusted shared support obligation is $4,492. They complete Steps 5 and 6 using this amount.

Other reasons

A judge can also order a parent to pay more or less than the guideline amount if qualifying circumstances, such as high medical expenses or a new spouse's income, call for it.

There are separate formulas for cases involving more than six children or a paying parent with multiple families.

Applying for child support

The child you're seeking support for must have a legal father. Parents who weren't married at the time of their child's birth can establish paternity by signing an Acknowledgment of Paternity together or opening a paternity case through a child support application.

Either parent can apply for child support online.

After your county's Domestic Relations Section approves your application, both parents attend a meeting where a conference officer issues a temporary child support order.

If you disagree with the amount, you can appeal before the decision becomes a final order. Generally, you must file an appeal within 20 days. Then you'll have a hearing before another officer or a judge, where a final decision is made. Every county has a different procedure, so check your local rules.

Modifying your support order

Modification may be necessary if a parent's finances change, the parenting timeshare shifts, or a child turns 18 and finishes high school. Use Pennsylvania's E-Services to file a petition for modification, or reach an agreement with the other parent and submit it to your county's Domestic Relations Section for approval.

Other child support details

If you receive public assistance, support payments go to the Department of Public Welfare. Each month, they'll send you a "pass through" check — a portion of the full support payment. You'll receive up to $100 if you have one child, and up to $200 if you have more than one child.

Custody and child support are handled in separate court orders. Failure to follow one doesn't affect the other. If one parent misses child support payments, the other cannot withhold visitation, and if one parent withholds visitation, the other cannot refuse to pay child support.

A child support order is legally binding and must be taken seriously. If you cannot pay as ordered, the court can seize your income tax refund or garnish your wages. If you simply choose not to pay, a court can find you in contempt and even send you to jail.

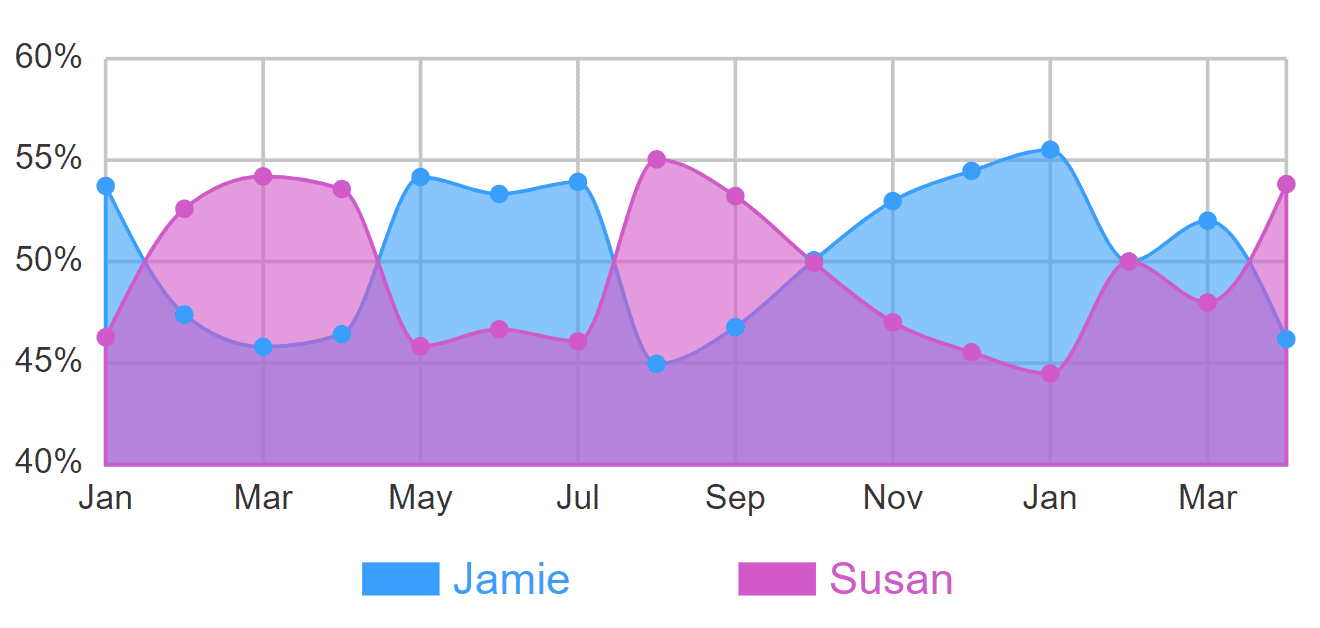

Don't guess or estimate your number of overnights

Estimating your parenting time can impact your support order by thousands of dollars a year if you're on the verge of qualifying for a deduction.

Still, lawyers and courts usually estimate because manually calculating overnights is tedious and time-consuming.

The Custody X Change app lets you quickly and accurately calculate your exact number of overnights.

You can customize this to fit your situation with Custody X Change.

With Custody X Change, you can tweak your schedule to see how even little changes affect your timeshare. And you can see how your time changes each year due to holidays and other events.

Whether you are the one paying or receiving child support, make sure your overnight calculation is exact. The number will affect you, your child and the other parent. It's not a job for estimation.