Illinois child support & parenting time calculations

Child support is the money parents pay to cover their child's needs, including food, clothing and shelter. The nonprimary parent (generally whoever has less parenting time) usually pays their share to the primary parent.

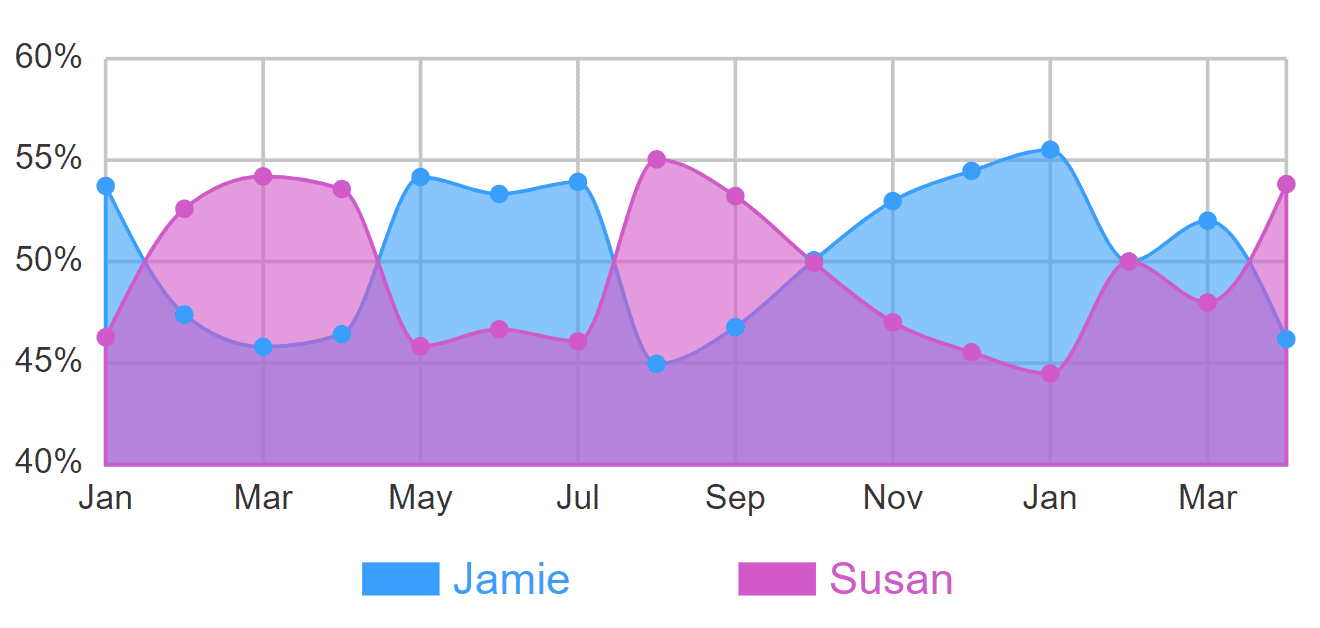

The basic child support formula is used when one parent has over 60 percent of time in the parenting time schedule. Otherwise, a shared parenting support formula applies. (You can calculate your parenting time instantly with Custody X Change.)

Judges don't often deviate from these formulas. However, if a child has special needs or requires additional care, a judge may increase the support owed.

Support payments end when the child turns 18. If your child is still in high school then, payments will continue until they graduate or turn 19, whichever comes first.

Basic child support formula

To estimate your child support payment when one parent has more than 40 percent of parenting time (219 nights a year), use the calculator above or the steps below.

Step 1: Determine net income

Begin by calculating each parent's gross monthly income, excluding public assistance and other child support owed or received. Then convert each parent's gross income to net income using the standard conversion chart. Add the net figures together to get the parents' combined adjusted net income.

Example: Each parent makes $4,500 a month. Using the conversion chart, the primary parent has a net income of $3,581, while the nonprimary parent has a net income of $3,527. Their combined adjusted net income is $7,108.

Step 2: Find your percentage contribution

Divide your individual net income by the combined adjusted net income. Multiply this figure by 100 to find your percentage contribution.

Example: The nonprimary parent has a net income of $3,527. Divide this number by $7,108, the combined adjusted net income from Step 1. The result (.496) shows the nonprimary parent has a percentage contribution of 49.6%. The primary parent has a percentage contribution of 50.4%.

Step 3: Calculate the basic support obligation

Determine the basic support obligation by using your combined adjusted net income from Step 1 and the Illinois income shares table. The obligation will increase as the number of children increases.

Example: Our parents have one child. Their $7,108 combined adjusted net income results in a basic support obligation of $1,295.

Step 4: Determine your total support obligation

Multiply your percentage contribution (from Step 2) by the basic support obligation (from Step 3) to determine your share of child support. If you are the nonprimary parent, you will pay your share to the primary parent. If you are the primary parent, the state assumes you spend your share on the child during your caretaking time.

Example: The nonprimary parent multiplies their percentage contribution (.496) by the basic support obligation, $1,295. They will pay $642 in monthly child support to the primary parent.

Shared parenting support formula

When both parents have at least 40 percent of parenting time (146 nights a year), use the calculator above or the formula below. This formula generally produces a lower payment than the basic child support formula.

Step A: Find your shared parenting obligation

Complete Steps 1 through 3 from the basic child support formula outlined above.

Then take the basic support obligation from Step 3 and multiply it by 1.5 to get the shared parenting obligation.

Example: Multiply the $1,295 basic support obligation by 1.5 to get a shared parenting obligation of $1,943.

Step B: Find your individual support share

Multiply the shared parenting obligation by your percentage contribution from Step 2.

Example: The nonprimary parent multiplies the shared parenting obligation ($1,943) by their percentage contribution (.496) to get an $964 individual support share. The primary parent's individual support share is $979.

Step C: Determine your total obligation

Multiply your individual support share by the other parent's percentage of parenting time. (You can use Custody X Change to calculate parenting time percentages.) The result is your monthly child support obligation.

Then repeat for the other parent.

Example: The primary parent spends 55 percent of the year with the child, while the nonprimary parent spends 45 percent of the year with the child. Therefore, the nonprimary parent multiplies their $964 share by .55 for a total obligation of $530. The primary parent multiplies their $857 share by .45 for a total obligation of $441.

Step D: Determine the monthly payment

Subtract the lower obligation from the higher obligation. This is the amount the parent with the higher obligation must pay each month.

Example: The nonprimary parent has a higher obligation and pays the $89 difference to the primary parent each month.

Low-income exceptions

If you owe child support according to the above formulas, and you have an income below 75 percent of the Federal Poverty Guidelines, your monthly payment is $40 per child, capped at $120 (even with more than three children).

If you have a disability, are serving prison time or have no income due to circumstances outside your control, you may not have to pay child support.

Failure to pay

It is important you pay your obligated child support to avoid penalties. Any parent owed money can inform the Division of Child Support Services (DCSS), which may trigger an investigation.

If a parent fails to pay child support for six months or owes more than $5,000, the DCSS may seek prosecution. This could result in a misdemeanor charge. If payments are a year late or the amount owed exceeds $20,000, this may result in a felony with possible jail time.

Modifying child support

If your family experiences a significant change in circumstances, such as a major increase in a parent's salary, you can ask the court to modify your child support order.

You must prove to the court that the significant change in circumstances affects the child's well-being.

Even without a change in circumstances, you can request child support modification every three years.

Parents can also agree to modify child support payments and ask a judge for approval. If the modification meets state guidelines, the judge will likely sign off on the new order.

Getting accurate parenting time figures

Estimating parenting time can impact your support order by thousands of dollars a year. Your amount of overnight visits not only determines which support formula you use, but it is also a direct component of the shared parenting formula.

Still, lawyers (and even courts) usually estimate parenting time because calculating it manually is time-consuming.

Luckily, the Custody X Change app lets you quickly and accurately calculate your exact parenting time.

You can customize this to fit your situation with Custody X Change.

With Custody X Change, you can tweak your schedule to see how even little changes affect your parenting time. And you'll see how your time changes each year due to holidays and other events.

Custody technology also prevents common mathematical errors, such as double-counting time.

Remember that a child support order is legally binding and must be taken seriously.

Whether you are the one paying or receiving child support, make sure your overnights count is exact. The number will affect you, your child and the other parent for years to come.